With 67% ownership of the shares, Under Armour, Inc. (NYSE:UAA) is heavily dominated by institutional owners - Simply Wall St News

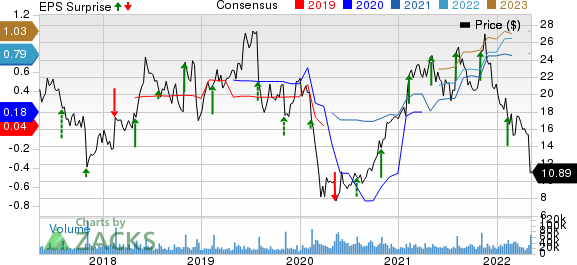

Why Under Armour Stock Moved: UA Stock Has Lost 43% Since 2019 Primarily Due To Unfavorable Change In Price To Sales Multiple (P/S) | Trefis

![Under Armour Inc (UAA) Stock 5 Years History [Returns & Performance] Under Armour Inc (UAA) Stock 5 Years History [Returns & Performance]](https://www.netcials.com/tools/phpgraphlib-master/image/nyse-stock-5years/5-year-monthly-price-chart-Under-Armour-Inc.png)